1. Understanding Denial Code 112

Denial Code 112 means the insurance company believes the service was either not provided directly to the patient or there isn’t enough documentation to prove the service actually happened. Think of it like this: if you can’t prove you did your homework, your teacher won’t give you credit for it. Insurance companies need clear proof that medical services were actually performed for the specific patient.

This denial commonly occurs when documentation is missing key details like who performed the service, when it was done, what exactly was provided, or if the service was done by someone else (like a lab) instead of the billing provider. It also happens when services are billed as if done in the office but were actually performed elsewhere, or when there’s confusion about whether the provider personally delivered the care.

2. Real-Time Example with Sarah

Sarah’s Story (repeated scenario): Sarah went to Dr. Johnson’s clinic for blood work. Dr. Johnson’s office sent Sarah’s blood sample to an outside laboratory, but then billed the insurance as if Dr. Johnson performed the lab test himself in his office. The insurance company denied the claim with Code 112 because Dr. Johnson didn’t actually perform the service directly – the outside lab did. Sarah’s case shows why it’s important to bill correctly based on who actually provided the service and where it was performed.

3. Fields to Check in Claim Forms

| CMS-1500 Form | UB-04 Form | What to Verify |

|---|---|---|

| Box 24D – Diagnosis Pointer | FL 76 – Attending Physician | Matches the actual treating provider |

| Box 24J – Rendering Provider | FL 77 – Operating Physician | Provider who actually performed service |

| Box 32 – Service Facility | FL 4 – Type of Bill | Correct location where service occurred |

| Box 33 – Billing Provider | FL 81 – Other Physician | Proper billing entity |

| Box 24A – Date of Service | FL 45 – Date of Service | Accurate service dates |

| Box 24B – Place of Service | FL 42 – Revenue Code | Appropriate place of service code |

| Box 21 – Diagnosis Codes | FL 67 – Principal Diagnosis | Supporting diagnosis documentation |

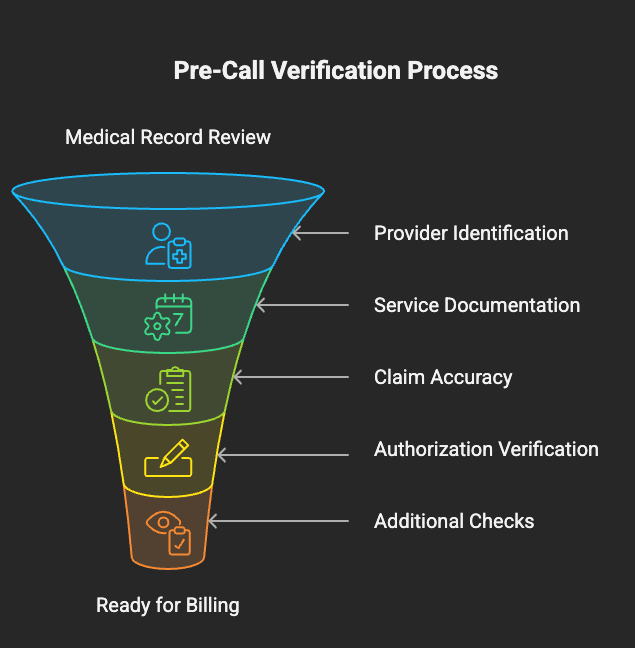

4. Pre-Call Verification Checklist

Before calling the insurance company, verify:

□ Patient’s medical record contains detailed service documentation □ Provider who performed service is clearly identified in records.

□ Service location is accurately documented and matches claim □ Date of service matches between medical record and claim.

□ Proper place of service code is used on claim □ Rendering provider information is complete and correct.

□ Any required signatures or authorisations are present □ Diagnosis codes support the services provided.

□ Check if service was referred out to another provider/facility.

□ Verify if additional documentation was already sent.

□ Review previous claim submissions for this service.

□ Confirm patient was present for the service on the date listed.

□ Check if service requires specific documentation requirements.

□ Verify billing provider has the right to bill for this service.

5. Probing Questions for Insurance Representatives

Essential questions to ask the insurance rep:

- “Can you tell me specifically what documentation is missing to prove the service was provided directly to the patient?”

- “What evidence do you need to show that [Provider Name] personally performed this service on [Date]?”

- “Are you seeing any indication that this service was performed by an outside facility rather than our provider?”

- “What specific documentation would resolve this denial – do you need provider notes, signatures, or procedure reports?”

- “Is the denial because the place of service doesn’t match where you think the service was performed?”

- “Do your records show a different rendering provider than what we submitted?”

- “What documentation timeline do you require – does it need to be submitted within a specific timeframe?”

- “Are there specific format requirements for the documentation we need to submit?”

- “Can you confirm if this denial is due to missing documentation or because you believe the service wasn’t directly provided?”

6. Documentation Template

Call Documentation Format:

From _____________ dated _____________ agent name _____________ called _____________ and _____________ spoke to _____________. Probed for the denial _____________. Per rep claim denied on _____________ denied for _____________ under claim# _____________.

What is causing denial: _____________

What should be updated: _____________

How long for the payment turnaround time: _____________

Call reference number: _____________

Additional Information Gathered:

- Specific documentation requirements: _____________

- Format requirements for submission: _____________

- Submission method (fax, mail, portal): _____________

- Documentation review timeline: _____________

- Contact information for follow-up: _____________

Next Steps Required: □ Obtain missing documentation from provider □ Resubmit claim with corrected information □ Send additional documentation via [method] □ Follow up on documentation receipt □ Track claim status after resubmission

Follow-up Requirements:

- Follow-up date scheduled: _____________

- Documentation submission deadline: _____________

- Expected resolution timeframe: _____________

- Additional actions needed: _____________

Notes: Remember Sarah’s example – always verify that the provider billing for the service is the same provider who actually performed the service. If services were sent to outside facilities, proper billing procedures must be followed.

FAQ on Denial Code 112

Denial Code 112 means the insurance company doesn’t believe the service was provided directly to the patient by the billing provider, or there isn’t enough documentation to prove the service happened. It’s like trying to return something to a store without a receipt – you need proof of the transaction.

The most common reasons include:

- Missing or incomplete medical records

- Services performed by outside labs/facilities but billed as if done in-office

- Wrong rendering provider listed on the claim

- Incorrect place of service codes

- Missing provider signatures or documentation

- Services billed by wrong entity (like billing for another provider’s work)

Good documentation should clearly show:

- Who provided the service (specific provider name)

- When the service was provided (exact date and time)

- Where the service was provided (correct location)

- What service was provided (detailed procedure notes)

- Patient was present and received the service

- Provider signature and credentials

“Service not furnished directly” means the billing provider didn’t personally perform the service (maybe it was done by an outside lab or another provider). “Not documented” means there’s insufficient paperwork to prove any service happened at all. Both can trigger Code 112.

Usually you need to resubmit the claim with proper documentation rather than appeal. Appeals are typically for when you disagree with the insurance company’s decision, but Code 112 is usually about missing information that can be provided.

This varies by insurance company, but typically ranges from 30-90 days from the denial date. Always ask the insurance rep for specific timeframes during your call, as some companies have shorter deadlines.

If an outside facility performed the service:

- The outside facility should bill the insurance directly, OR

- You need proper documentation showing you have the right to bill for their services, OR

- You may need to bill as an intermediary with proper modifier codes

- Never bill as if you performed the service when you didn’t

Most insurance companies accept:

- Medical records with provider signatures

- Procedure notes with date, time, and provider identification

- Lab reports with ordering physician information

- Progress notes showing patient encounter

Always ask the specific insurance company about their preferred format.

Yes, always call first to:

- Confirm what specific documentation they need

- Get the correct fax number or submission method

- Obtain a reference number for your call

- Clarify any formatting requirements

- Get a timeline for review

Keep detailed records:

- Save fax confirmation sheets

- Keep copies of all submitted documents

- Document submission dates and methods

- Get confirmation numbers when possible

- Follow up within the specified timeframe to confirm receipt

Yes, by implementing these practices:

- Ensure complete documentation before claim submission

- Verify rendering provider information is accurate

- Use correct place of service codes

- Don’t bill for services performed by outside entities unless properly documented

- Maintain detailed medical records with provider signatures

- Regular staff training on documentation requirements

Resolution times vary but typically:

- Documentation review: 7-14 business days after submission

- Claim reprocessing: 5-10 business days after approval

- Payment: 2-4 weeks total from documentation submission

Always ask the insurance rep for their specific timeframes.

This depends on the situation:

- If only documentation is missing: Send documentation with original claim number

- If claim information is incorrect: Submit a corrected claim

- If provider information is wrong: Usually requires a new claim

Always clarify with the insurance company which method they prefer.

Handle each service separately:

- Identify which specific services lack documentation

- Gather appropriate documentation for each service

- Clearly label documentation by service date and procedure code

- Submit all documentation together with a cover letter explaining each service

Yes, especially when:

- Additional medical records are needed

- Provider signatures are missing

- Clarification about who performed the service is required

- The provider needs to confirm they personally delivered the service

- Documentation needs to be created or amended

Hey there!

Welcome to Moviezhive.com, where blockbuster entertainment is just a click away!

Stream a vast collection of Bollywood, Hollywood, and international movies for free—no subscriptions, no hassles.

What Makes Us Special?

✔️ Thousands of movies across all genres

✔️ Zero pop-up ads for seamless viewing

✔️ Advanced zero-buffering tech for smooth playback

✔️ Fresh titles added regularly

Can’t find a movie? Request it, and we’ll upload it fast!

Watch anytime, anywhere. Visit https://moviezhive.com now and start your movie adventure!

Enjoy the Show,

The Moviezhive Team