Direct Answer: What CO-213 Means and How to Fix It

Denial code CO-213 indicates non-compliance with physician self-referral prohibition legislation (Stark Law) or payer-specific anti-kickback policies.

Immediate action required: Review the referring physician’s financial relationships with your facility, verify compliance with Stark Law exceptions, and ensure proper documentation exists for any financial arrangements. This denial typically results from services billed when a physician refers patients to entities where they have a financial interest without meeting specific legal exceptions. Resolution involves documenting compliance with safe harbor provisions, correcting referral patterns, or appealing with proper legal documentation when arrangements are legitimate.

Root Causes That Trigger CO-213 Denials

Understanding what triggers a CO-213 denial is crucial for both resolution and prevention. The primary causes stem from violations of federal Stark Law (42 U.S.C. § 1395nn) and similar state regulations designed to prevent conflicts of interest in healthcare referrals.

Financial Relationship Red Flags:

- Physician ownership in diagnostic imaging centers, laboratories, or specialty clinics

- Compensation arrangements that vary with referral volume

- Medical directorships without fair market value documentation

- Space or equipment leases below market rates

- Investment interests in entities receiving referrals

Documentation Deficiencies:

- Missing written agreements for compensation arrangements

- Lack of fair market value assessments for services

- Inadequate records of compliance committee reviews

- Absence of legal counsel opinions on arrangements

Referral Pattern Anomalies: Payers use sophisticated analytics to identify unusual referral patterns. Claims are flagged when statistical analysis reveals referral volumes that significantly exceed peer benchmarks or show sudden increases coinciding with financial arrangements.

Real-World Case Study: Cardiology Group Self-Referral Violation

Patient: Robert Chen, Age 67

Insurance: Medicare Advantage (Humana)

Denial Code: CO-213

Amount: $2,847 for cardiac catheterisation

Scenario: Dr. Martinez, a cardiologist in private practice, referred Mr. Chen for cardiac catheterization at Riverside Cardiac Center. Unknown to the billing department, Dr. Martinez had recently acquired a 15% ownership stake in Riverside through a physician investment group. The facility had not updated their compliance documentation or implemented new referral protocols following the ownership change.

Resolution Steps:

- Compliance officer reviewed Dr. Martinez’s ownership documentation

- Legal counsel assessed whether ownership met Stark Law’s in-office ancillary services exception

- Discovered the arrangement fell outside safe harbor provisions

- Implemented immediate referral restrictions for Dr. Martinez

- Filed corrective action plan with Medicare

- Negotiated settlement for affected claims

Outcome: Three-month resolution timeline, $45,000 in total claim adjustments, implementation of monthly compliance monitoring

Lesson Learned: Ownership changes must trigger immediate compliance reviews and referral protocol updates before any claims are submitted.

What to Check: Specific Form Fields and Documentation

When addressing CO-213 denials, systematic verification of multiple data points is essential. The following checklist covers critical areas requiring review:

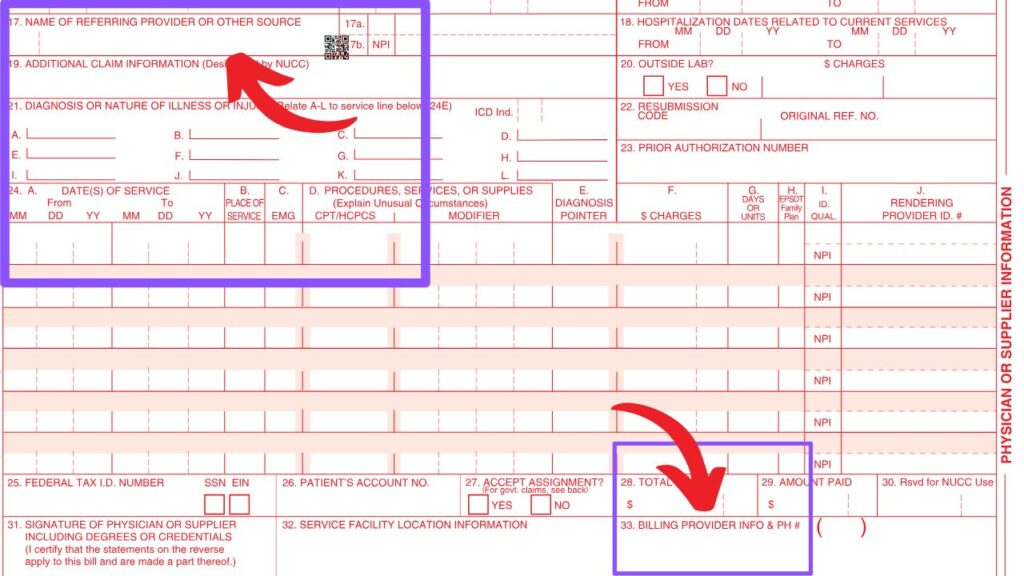

CMS-1500 Form Verification

| Box Number | Field Description | Check For |

|---|---|---|

| Box 17 | Name of Referring Provider | Cross-reference against ownership database |

| Box 17a | Other ID# of Referring Provider | Verify NPI against compliance records |

| Box 17b | NPI of Referring Provider | Match to internal conflict-of-interest listings |

| Box 33 | Billing Provider Info | Ensure no financial relationship with referring provider |

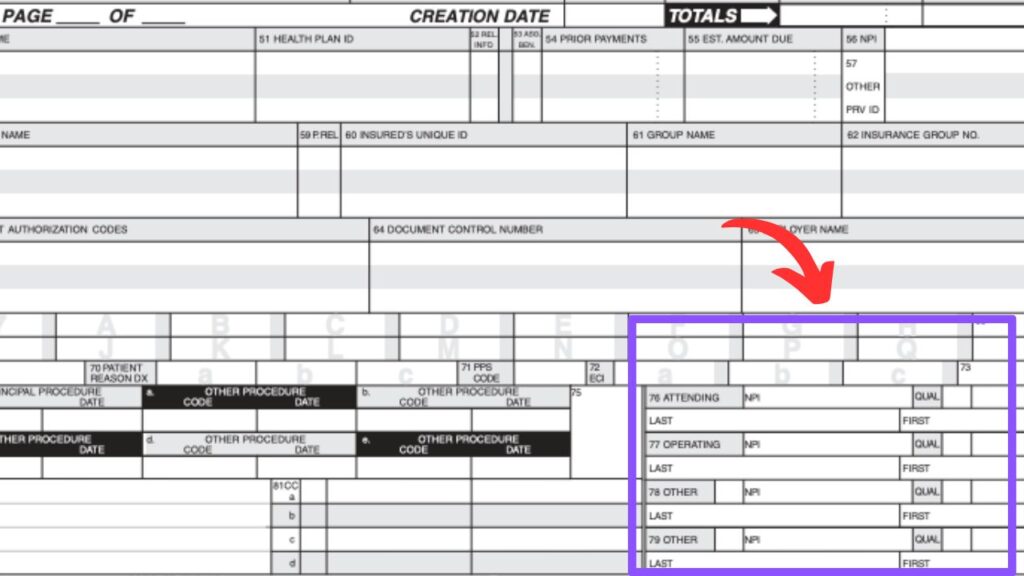

UB-04 Form Verification

| Box Number | Field Description | Check For |

|---|---|---|

| Box 76 | Attending Provider Name and Identifiers | Financial relationship documentation |

| Box 77 | Operating Provider Name and Identifiers | Ownership interest verification |

| Box 78-79 | Other Provider Information | Additional referring provider relationships |

Internal Documentation Requirements

Compliance Database Checks:

- Physician ownership interest registry

- Medical staff financial disclosure forms

- Vendor relationship agreements

- Lease and service contracts

- Investment partnership documentation

Legal Documentation Review:

- Stark Law compliance opinions

- Safe harbor provision analysis

- Fair market value assessments

- Anti-kickback statute compliance

Prevention Strategies: Building Robust Compliance Systems

Preventing CO-213 denials requires proactive compliance infrastructure that identifies potential violations before claims submission.

Step-by-Step Prevention Protocol

Phase 1: Initial Setup (Weeks 1-4)

- Establish compliance committee with legal, clinical, and billing representation

- Create comprehensive physician financial interest database

- Implement monthly disclosure requirements for all referring providers

- Develop automated referral pattern monitoring systems

- Create standardized legal review process for new financial arrangements

Phase 2: Ongoing Monitoring (Monthly)

- Update physician ownership database with quarterly disclosures

- Run referral pattern analytics comparing current to historical volumes

- Review new service line implementations for compliance implications

- Conduct fair market value assessments for all compensation arrangements

- Update training materials based on regulatory changes

Phase 3: Technology Integration

- Implement real-time alerts in practice management systems

- Create dashboard reporting for compliance officers

- Integrate with credentialing software for automatic updates

- Establish electronic workflow for legal review processes

Compliance Technology Tools

| Tool Category | Recommended Solutions | Key Features |

|---|---|---|

| Compliance Software | Symplr, NAVEX Global | Automated conflict screening |

| Analytics Platforms | MedAI, Change Healthcare | Referral pattern monitoring |

| Legal Documentation | DocuSign CLM, ContractWorks | Contract lifecycle management |

| Training Systems | Cornerstone OnDemand | Regulatory update delivery |

Resolution Process: Step-by-Step Claim Recovery

When CO-213 denials occur, systematic resolution prevents recurring violations while maximizing claim recovery potential.

Immediate Response Actions (Days 1-7)

Day 1: Claim Analysis

- Identify all affected claims using denial code filtering

- Extract referring provider information from claim data

- Cross-reference providers against compliance database

- Calculate total financial exposure from denied claims

- Notify compliance officer and legal counsel immediately

Days 2-3: Documentation Gathering

- Retrieve all financial arrangement documentation

- Compile physician disclosure forms and updates

- Collect legal opinions on existing arrangements

- Document referral volumes and patterns

- Gather fair market value assessments

Days 4-7: Initial Assessment

- Conduct legal review of all flagged relationships

- Determine which arrangements meet safe harbor provisions

- Identify claims eligible for immediate appeal

- Calculate potential settlement amounts for non-compliant arrangements

- Develop corrective action timeline

Detailed Resolution Workflow (Weeks 2-12)

Weeks 2-4: Compliance Remediation

- Restructure non-compliant financial arrangements

- Implement referral restrictions where necessary

- Update internal compliance documentation

- Establish ongoing monitoring protocols

- Document all corrective actions taken

Weeks 5-8: Appeal Preparation

- Prepare legal documentation for compliant arrangements

- Draft detailed appeal letters with supporting evidence

- Compile expert opinions on fair market value

- Create timeline of compliance efforts

- Submit appeals within required timeframes

Weeks 9-12: Follow-up and Monitoring

- Track appeal responses and adjudication

- Implement additional corrective measures as needed

- Update compliance policies based on lessons learned

- Establish enhanced monitoring for previously flagged providers

- Document resolution outcomes for future reference

Appeal Process: Forms, Timelines, and Requirements

CO-213 appeals require extensive legal documentation and strict adherence to regulatory timeframes. Success depends on demonstrating either compliance with safe harbor provisions or immediate corrective action.

Appeal Timeline Requirements

| Payer Type | First Level Appeal | Second Level Appeal | External Review |

|---|---|---|---|

| Medicare Traditional | 120 days | 180 days | 60 days |

| Medicare Advantage | 60 days | 30 days | 60 days |

| Medicaid | Varies by state | Varies by state | 30-60 days |

| Commercial | 30-180 days | 30-60 days | Varies |

Required Appeal Documentation

Legal Compliance Package:

- Stark Law compliance opinion from qualified healthcare attorney

- Documentation of safe harbor provision compliance

- Fair market value assessments for all compensation arrangements

- Timeline of compliance committee reviews

- Evidence of ongoing monitoring systems

Financial Documentation:

- Complete financial arrangement agreements

- Bank records supporting fair market value payments

- Independent appraisal reports where applicable

- Audit reports confirming compliance

- Insurance coverage for compliance-related losses

Appeal Letter Template Structure

Opening Section:

- Clear identification of denial code and specific claims

- Summary of compliance position and legal basis

- Request for reversal based on documented compliance

Evidence Section:

- Detailed explanation of applicable safe harbor provisions

- Documentation of fair market value determinations

- Timeline of compliance efforts and monitoring

- Expert opinions supporting arrangement legitimacy

Conclusion Section:

- Summary of compliance demonstration

- Request for specific action (reversal, adjustment, settlement)

- Contact information for follow-up communications

Tools & Software Recommendations for CO-213 Management

Effective management of Stark Law compliance requires specialized technology solutions that integrate with existing billing and clinical systems.

Compliance Management Platforms

| Software Solution | Key Features | Pricing Range | Best For |

|---|---|---|---|

| Symplr Compliance | Automated conflict screening, policy management | $15,000-$50,000/year | Large health systems |

| NAVEX Global | Risk assessment, training delivery, reporting | $10,000-$30,000/year | Mid-size practices |

| MetricStream | Integrated GRC platform, workflow automation | $25,000-$75,000/year | Enterprise organizations |

| SimpleCompliance | Basic conflict tracking, disclosure management | $5,000-$15,000/year | Small to medium practices |

Analytics and Monitoring Tools

Referral Pattern Analysis:

- MedAI Compliance Analytics: Real-time referral monitoring with statistical analysis

- Change Healthcare ClaimsXten: Pattern recognition for unusual referral volumes

- Cotiviti: Comprehensive compliance monitoring with predictive analytics

Financial Arrangement Tracking:

- ContractWorks: Contract lifecycle management with compliance alerts

- Agiloft CLM: Automated renewal notifications and compliance tracking

- DocuSign CLM: Electronic signature integration with compliance workflows

Integration Considerations

Practice Management System Integration:

- Epic: Native compliance modules with referral tracking

- Cerner: Integrated conflict-of-interest screening

- AllScripts: Third-party compliance tool integration capabilities

- NextGen: Built-in provider relationship management

Implementation Timeline:

- Weeks 1-2: Vendor selection and contract negotiation

- Weeks 3-6: System configuration and data migration

- Weeks 7-8: Staff training and workflow development

- Weeks 9-12: Go-live support and optimization

Staff Training Steps for Stark Law Compliance

Comprehensive staff training is essential for preventing CO-213 denials and maintaining ongoing compliance with self-referral regulations.

Training Program Structure

Phase 1: Leadership Training (Week 1)

| Role | Training Duration | Key Topics |

|---|---|---|

| Compliance Officers | 16 hours | Stark Law details, safe harbor provisions, audit procedures |

| Legal Counsel | 8 hours | Recent regulatory changes, enforcement trends |

| Revenue Cycle Directors | 12 hours | Billing implications, denial management, appeal processes |

| Medical Staff Leadership | 8 hours | Physician obligations, disclosure requirements |

Phase 2: Department-Specific Training (Weeks 2-3)

Billing Department (8 hours):

- Recognition of potential self-referral situations

- Proper documentation requirements for claims

- Appeal preparation and submission procedures

- Technology tools for compliance checking

Registration/Scheduling (4 hours):

- Patient intake procedures for referral verification

- System alerts for potential compliance issues

- Escalation procedures for questionable referrals

Medical Staff (6 hours):

- Disclosure obligation requirements

- Safe harbor provision overview

- Documentation standards for financial arrangements

- Consequences of non-compliance

Phase 3: Ongoing Education (Monthly)

- Regulatory update briefings (1 hour monthly)

- Case study reviews of actual violations (quarterly)

- Technology system updates and training (as needed)

- Compliance audit findings and corrections (quarterly)

Training Effectiveness Measurement

Knowledge Assessment Methods:

- Pre and post-training competency testing

- Scenario-based evaluation exercises

- Peer review of actual case handling

- Compliance audit performance metrics

Ongoing Competency Verification:

- Annual recertification requirements

- Continuing education credit tracking

- Performance improvement plan development

- Regular policy acknowledgment documentation

Financial Impact & Key Performance Indicators

Understanding the financial implications of CO-213 denials helps organizations prioritize compliance investments and measure program effectiveness.

Financial Impact Analysis

Direct Costs of CO-213 Denials:

- Average denied claim value: $1,200-$4,500 per service

- Appeal preparation costs: $500-$1,200 per claim

- Legal consultation fees: $300-$500 per hour

- Settlement negotiations: 60-80% of original claim value

Indirect Compliance Costs:

- Technology system implementation: $25,000-$100,000

- Staff training and certification: $15,000-$50,000 annually

- Legal compliance reviews: $50,000-$150,000 annually

- Ongoing monitoring systems: $20,000-$75,000 annually

Key Performance Indicators for Compliance Programs

Quantitative Metrics:

| KPI Category | Metric | Target Range | Measurement Frequency |

|---|---|---|---|

| Denial Rates | CO-213 denials per 1,000 claims | <0.5 | Monthly |

| Financial Impact | Total CO-213 denial amounts | <$25,000/month | Monthly |

| Appeal Success | CO-213 appeal overturn rate | >75% | Quarterly |

| Response Time | Average resolution timeline | <90 days | Quarterly |

Qualitative Metrics:

- Compliance training completion rates (target: 100% within 90 days)

- Policy acknowledgment documentation (target: 100% annually)

- Corrective action implementation timeliness (target: <30 days)

- Vendor relationship documentation completeness (target: 100%)

ROI Calculation for Compliance Programs

Cost-Benefit Analysis Framework:

Annual Compliance Program Cost: $150,000

Annual CO-213 Denial Reduction: $300,000

Legal Risk Mitigation Value: $500,000

Total Annual Benefit: $800,000

Net ROI: 433%

Break-Even Analysis: Most comprehensive compliance programs achieve break-even within 6-9 months through denial reduction and risk mitigation. The investment typically pays for itself through:

- Reduced denial rates (40-60% improvement)

- Faster appeal resolution (30-50% timeline reduction)

- Lower legal consultation costs (50-70% reduction)

- Improved payer relationships and trust

Benchmarking Against Industry Standards

Industry Performance Benchmarks:

- Top-performing organizations: <0.2 CO-213 denials per 1,000 claims

- Average performers: 0.5-1.0 CO-213 denials per 1,000 claims

- Below-average performers: >1.5 CO-213 denials per 1,000 claims

Organizations should establish baseline measurements before implementing compliance programs and track improvement over 12-18 month periods to demonstrate program effectiveness.

Summary and Key Action Items

CO-213 denials represent serious compliance violations that require immediate, comprehensive response. Success in managing these denials depends on proactive compliance systems, thorough documentation, and swift corrective action when violations occur.

Immediate Actions (Next 30 Days):

- Conduct comprehensive audit of all physician financial relationships

- Implement automated screening for potential self-referral violations

- Establish legal review process for all new financial arrangements

- Create compliance committee with defined responsibilities and meeting schedule

- Develop appeal template library with required legal documentation

Long-term Strategic Initiatives (3-12 Months):

- Invest in compliance technology platforms for ongoing monitoring

- Establish comprehensive staff training programs with regular updates

- Create vendor management systems for tracking all financial relationships

- Develop predictive analytics for identifying potential violations

- Build relationships with healthcare compliance legal counsel

The complexity of Stark Law compliance requires ongoing attention and significant resource investment. However, the financial and reputational risks of violations far exceed the costs of comprehensive compliance programs. Organizations that prioritize proactive compliance management typically see substantial improvements in denial rates, appeal success, and overall financial performance within the first year of implementation.

Frequently Asked Questions

Q: How quickly must we respond to CO-213 denials? A: Initial response should occur within 24-48 hours to assess compliance exposure. Formal appeals must be submitted within payer-specific timeframes, typically 30-120 days from denial date.

Q: Can we continue billing while appealing CO-213 denials? A: New claims for the same referring provider relationship should be suspended pending compliance review and corrective action implementation.

Q: What’s the difference between Stark Law and Anti-Kickback Statute violations? A: Stark Law is a strict liability statute focusing on referral relationships, while Anti-Kickback Statute requires intent to induce referrals. Both can trigger CO-213 denials.

Q: Are there safe harbor provisions that allow physician financial relationships? A: Yes, numerous exceptions exist including fair market value compensation, physician recruitment, and in-office ancillary services, but each requires specific documentation and compliance requirements.

Q: How do payers detect potential self-referral violations? A: Sophisticated analytics identify unusual referral patterns, cross-reference provider databases, and flag relationships requiring review based on volume and timing anomalies.